56+ what percentage of monthly income should go to mortgage

With a Low Down Payment Option You Could Buy Your Own Home. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

. Why Rent When You Could Own. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Tired of Renting.

With a Low Down Payment Option You Could Buy Your Own Home. Web While 43 is the highest DTI that borrowers can typically have and still qualify for a conventional mortgage most lenders prefer borrowers with a back-end ratio. It is a loan and you must be 62.

PIMCO Corporate Income Strategy Fund NYSE. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. And you should make.

With a Low Down Payment Option You Could Buy Your Own Home. Comparisons Trusted by 55000000. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

When determining what percentage of. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Web The 36 should include your monthly mortgage payment. Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. With a Low Down Payment Option You Could Buy Your Own Home. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Find Out If You Qualify Now.

PCN 0112500--PIMCO Corporate Income Opportunity Fund. Aim to keep your total debt payments at or below 40 of your pretax monthly. Web Percentage Change From Previous Month.

With that your other monthly debt should fit in under the overarching cap of 36. Why Rent When You Could Own. Apply Get Pre-Approved Today.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. John in the above example makes.

Web What percentage of your monthly income should go to mortgage. Save Real Money Today. So if your gross.

Compare the Best Conventional Home Loans for March 2023. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad Tired of Renting.

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of Income Should Go To Mortgage

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Income Should Go To Mortgage

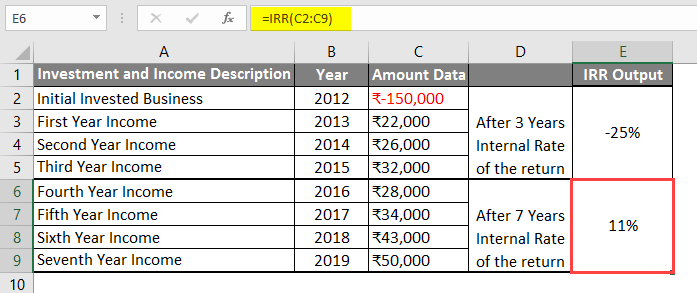

Excel Irr Formula How To Use Excel Irr Formula

What Is The 28 36 Rule Lexington Law

What Percentage Of Your Monthly Income Should Go Toward Your Mortgage Sapling

Financial Report 2017 By African Development Bank Issuu

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Mortgage Broker Home Loans In Lane Cove Chatswood Mortgage Choice

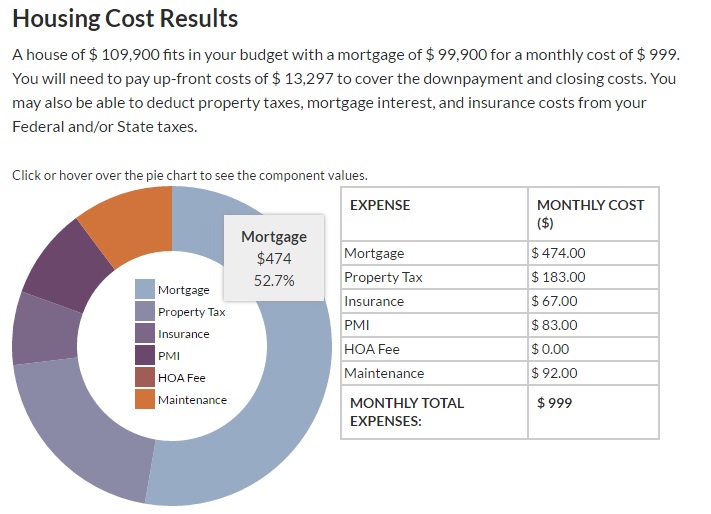

How Much House Can I Afford This Mortgage Affordability Calculator Tells You February 2023

Conservative Mortgage Calculator How Much Home Can You Really Afford Personal Finance Data

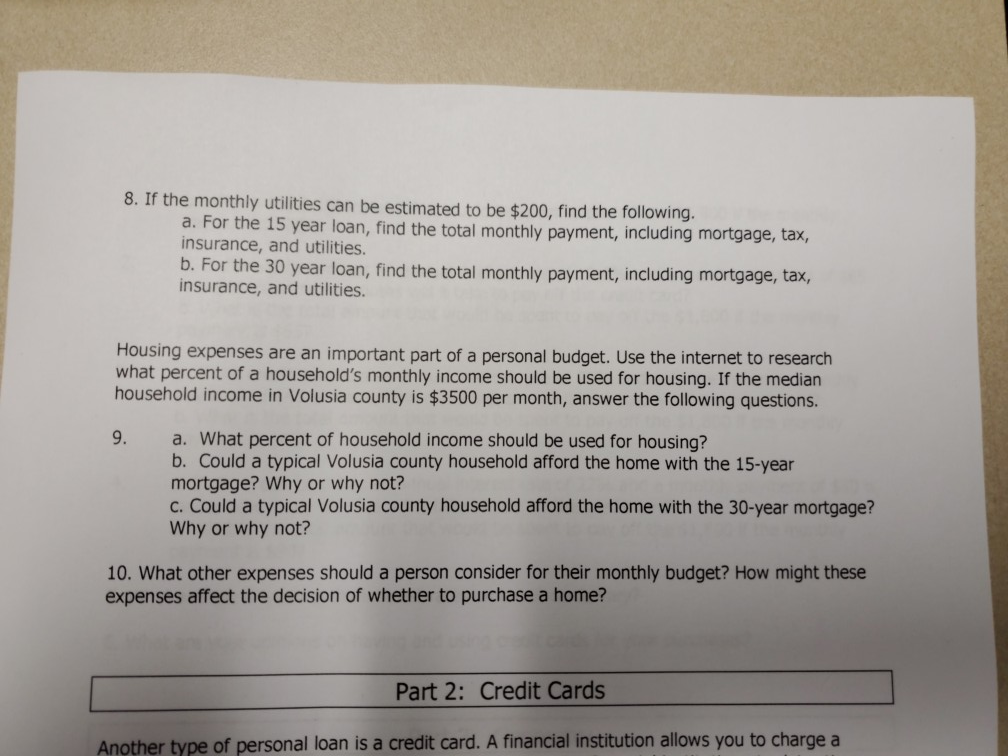

Solved Part 1 Mortgage A Mortgage Is A Loan Used To Chegg Com

How Much House Can You Afford Readynest

What Percentage Of Income Should Go To Mortgage Morty

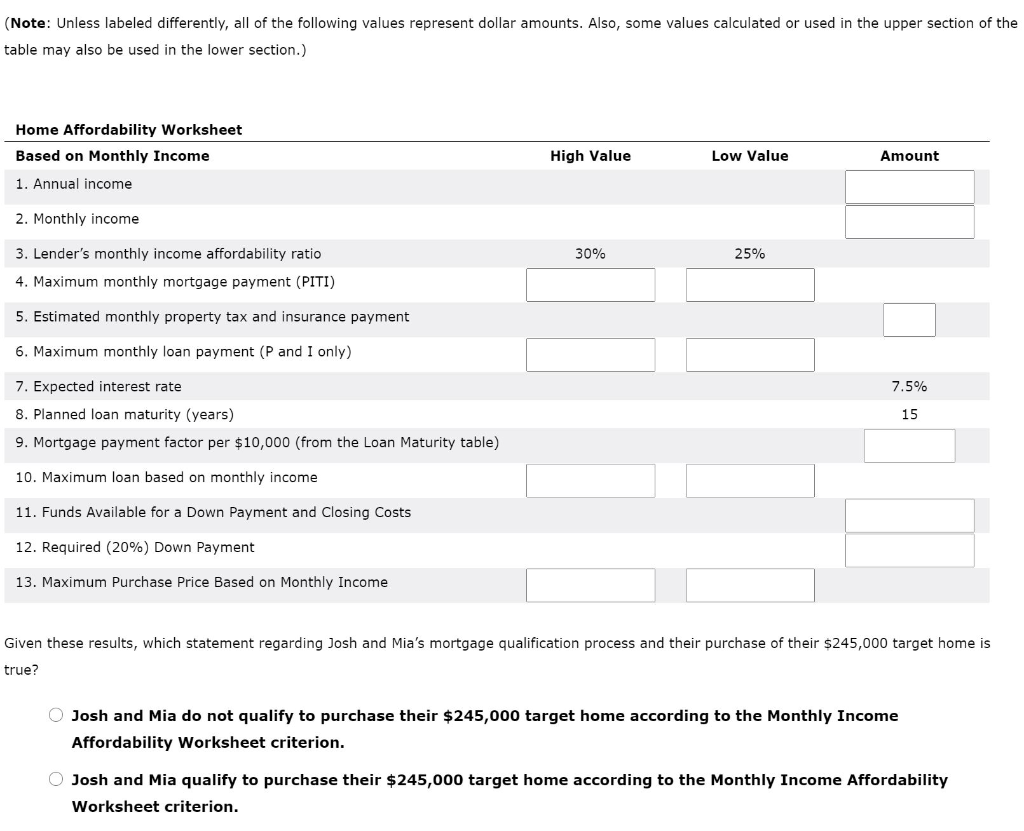

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com